Stablecoin Transaction monitoring

Comprehensive on-chain analytics helping banks, fintechs, exchanges, and stablecoin issuers detect illicit behavior, monitor transactions, assess wallet risk, and meet global compliance standards.

Comprehensive on-chain analytics helping banks, fintechs, exchanges, and stablecoin issuers detect illicit behavior, monitor transactions, assess wallet risk, and meet global compliance standards.

350+ COMPLIANCE & DIGITAL ASSET TEAMS TRUST US

WHY IS IT IMPORTANT?

Stablecoins are transforming the financial landscape, offering a fast, transparent, and borderless alternative to traditional payment systems

Regulators expect the same compliance controls as in traditional finance.

Institutions must screen wallets monitor flows report risks.

Scorechain delivers the infrastructure to meet these requirements.

Built for integration auditability control.

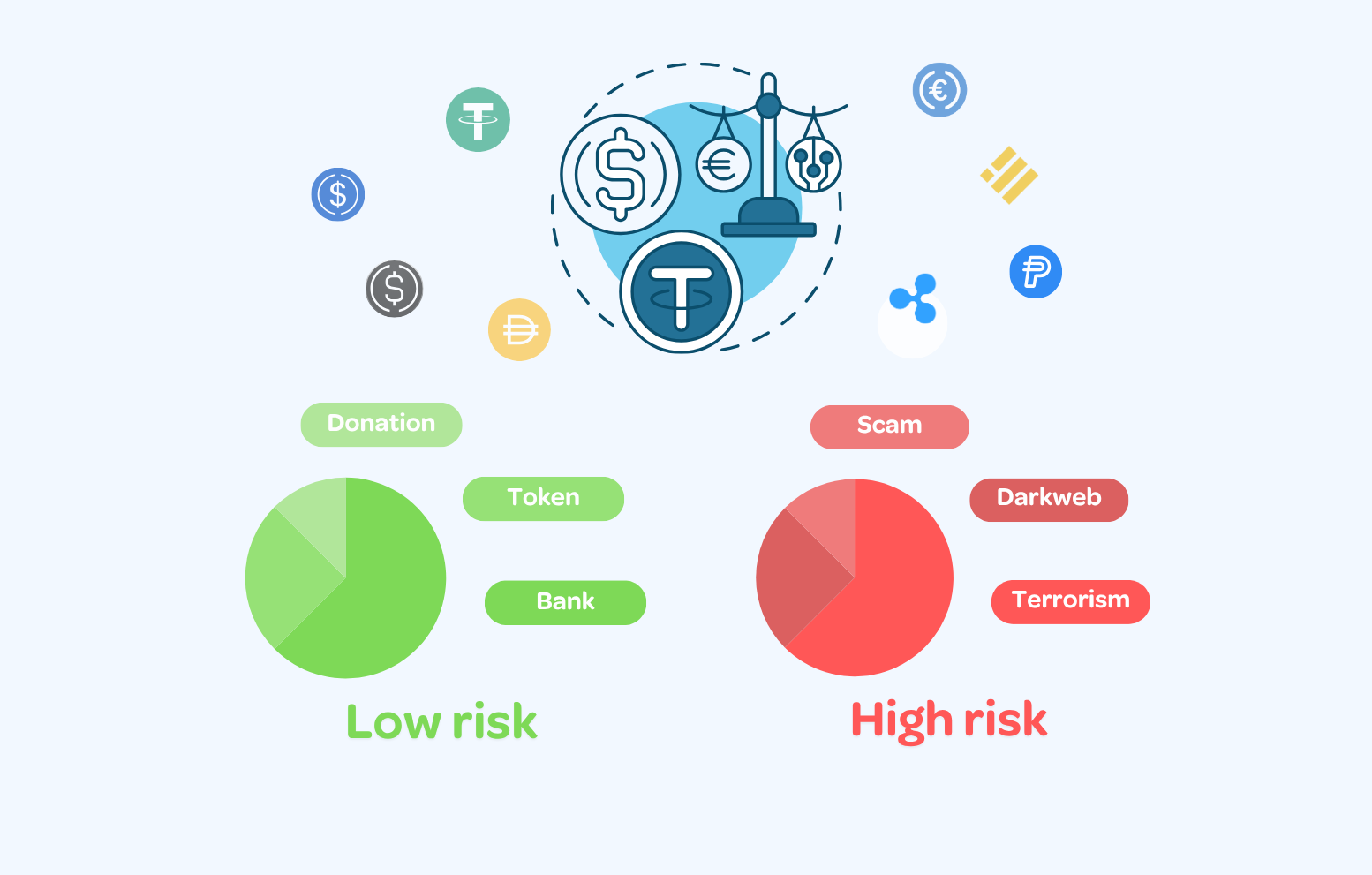

Monitor USDT, USDC, EURC, EURCV and all others coins, Identify risk exposure, mixers, and darknet markets. Stay aligned with FATF, MiCA, and global AML directives.

Get instant alerts on high-risk transactions and exposure to sanctioned entities. Detect complex typologies such as cross-chain payments, layering and abnormal velocity and stay ahead of emerging risks. Automated wallet scoring and origin-of-funds assessments across stablecoin flows. Screen for sanctions (OFAC, EU, UN), jurisdictional risk, and counterparty behavior.

Integrate real-time monitoring directly into your compliance workflows through our SDKs and API.

Connect seamlessly with leading digital asset custodians such as Fireblocks, Taurus, and Metaco.

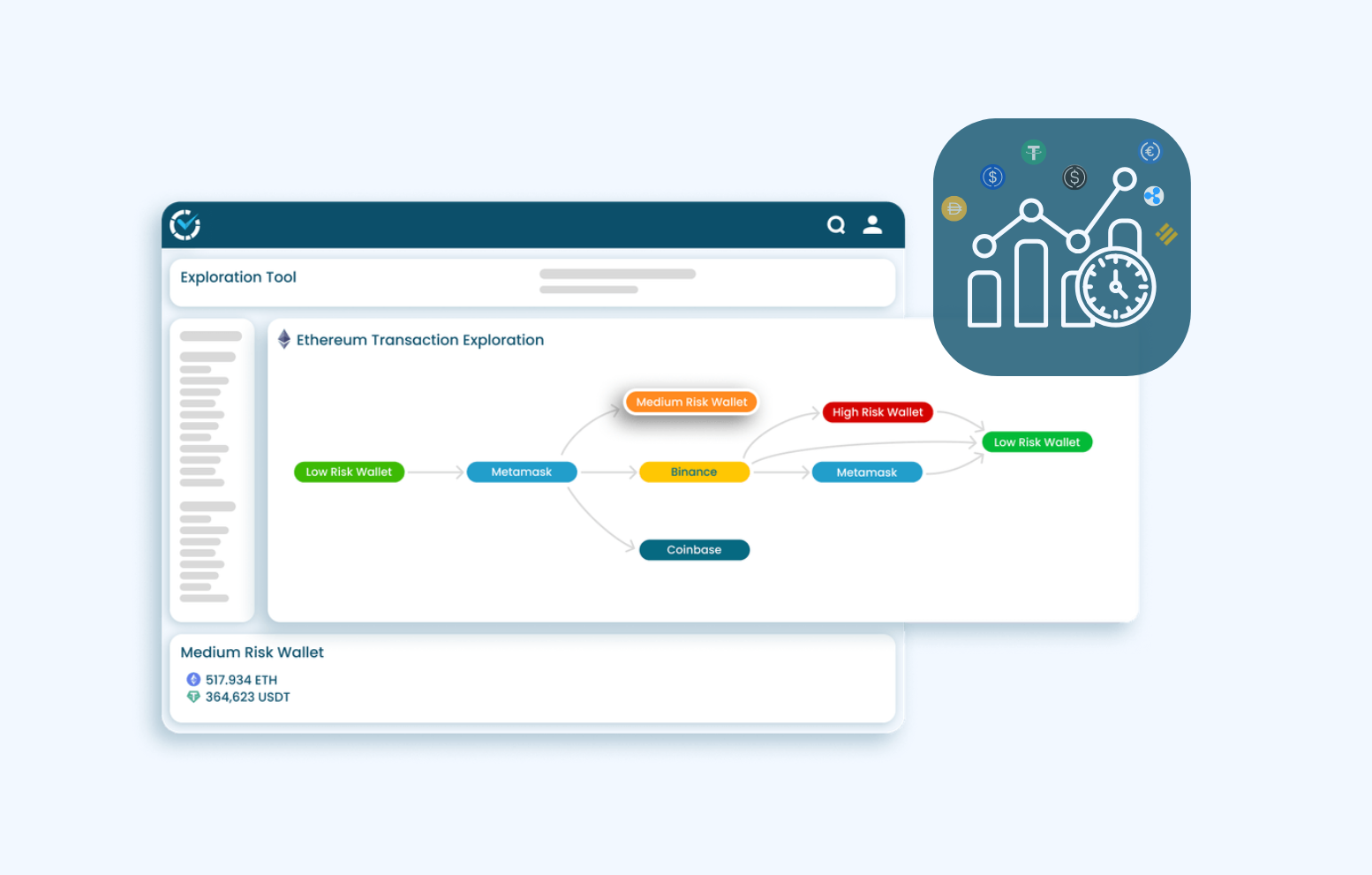

Access detailed analytical reports explaining transaction risk and exposure context.

Maintain full auditability with regulator-ready documentation and evidence trails.

HOW DOES IT WORK?